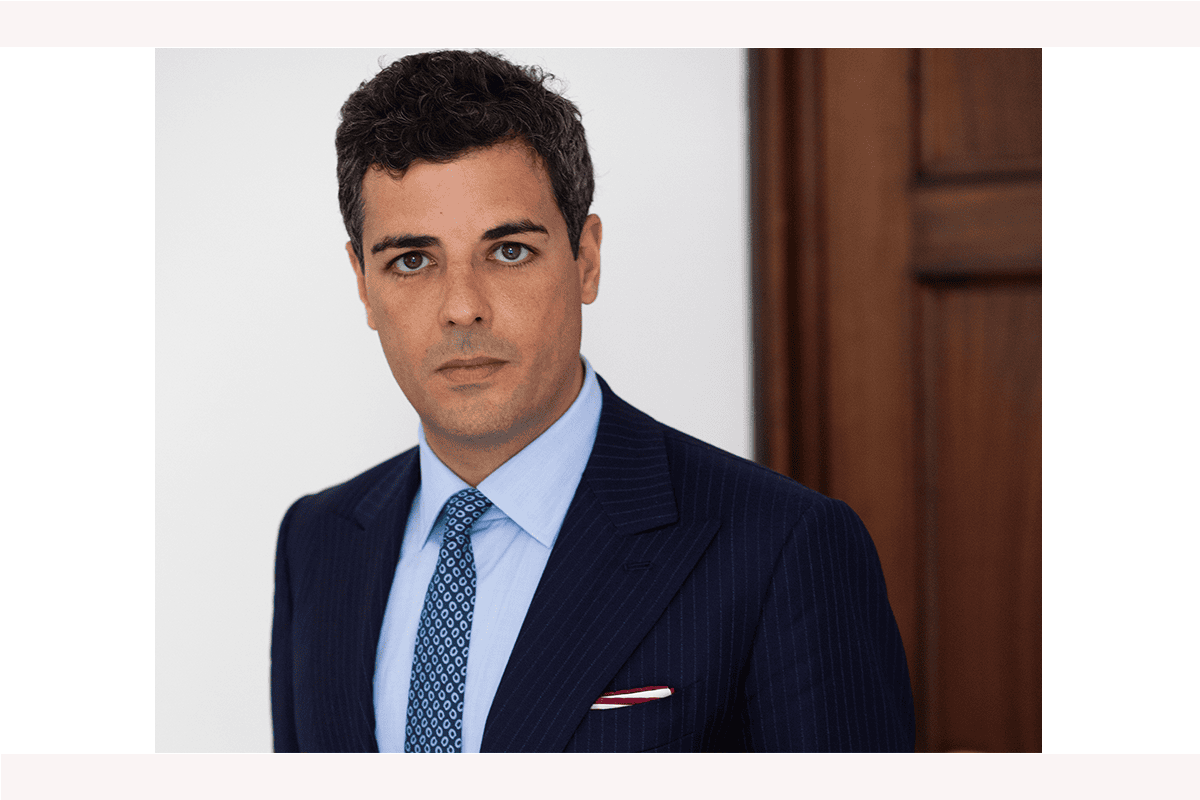

Through the insights of founding partner Francesco Dagnino, LEXIA has provided an in-depth analysis of the mergers and acquisitions (M&A) market in Italy in 2024, highlighting the key factors driving the sector’s growth. Dagnino emphasized that the gradual reduction in interest rates and the increase in available capital from private equity have contributed to a favorable environment for M&A transactions, despite market volatility.

In particular, Dagnino highlighted the importance of private debt as an alternative to bank credit, emphasizing its flexibility in financing operations in strategic sectors such as renewable energy and industry. This form of financing has enabled a steady flow of investments, even in a context of rising interest rates in recent years. Looking ahead, Dagnino noted that Italy continues to be an attractive market for international investors, particularly due to the strength of the manufacturing sector and the presence of investors with significant capital ready to be allocated. However, Dagnino pointed out that it will be essential for Italian companies to adapt to more cautious valuations and lower multiples compared to previous years, considering the increased selectivity of investors.

Forecasts for the second half of 2024 remain positive, with particular attention to the Banking & Financial Institutions sector and Infrastructure. The technology and sustainability sectors continue to play a leading role in M&A transactions, serving as key drivers of economic transformation towards digitization and sustainability.

The full contribution from Francesco Dagnino is available in the article on EconomyMagazine.it.